South African racing may be able to learn from our Hong Kong counterparts when it comes to focussing on the needs of potential customers and identifying the various target markets.

Maybe start by dismantling the Racing Itsa Rush smoke and mirrors platform and apply some genuine science, market research – and even logic – in a genuine effort to recapture market share?

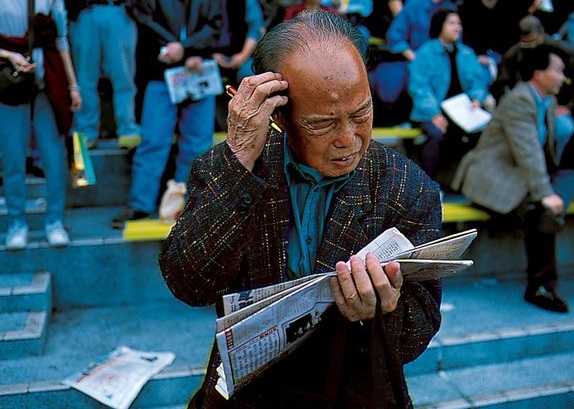

Age-friendly facilities, bigger font types in specific publications, nostalgic marketing campaigns and assistance to promote senior use of digital channels have all been employed in Hong Kong to win back a market that once formed the customer support backbone of the game.

Speaking at the 37th Asian Racing Conference in Seoul this week, Richard Cheung, the Hong Kong Jockey Club’s Executive Director, Customer and International Business Development, said Hong Kong strategy centred on sustaining turnover growth via three principal targets: micro-demographic targeting of seniors (60 plus) and females under 45; commingling partnerships and specific information dissemination to overseas customers; and leveraging new technologies to ensure a seamless customer experience.

“We have had a good run, last year turnover grew by 10 percent and this year we expect another five or six percent growth, but we do not think we can sit on our laurels. We are now planting the seeds for another good run,” said Mr. Cheung.

“Those racing fans who lapsed, who dropped away from the sport due to work and family commitments in middle age, with our tactics, we are seeing that some are returning now that they are retired. Not only that, the lapse rate is dropping,” he said, adding that age-friendly facilities, bigger font types in specific publications, nostalgic marketing campaigns and assistance to promote senior use of digital channels have all been employed.

Relative to the HKJC’s focus on attracting female racegoers under 45, Mr Cheung suggested the micro-mining of demographics has led to short-term wins.

“We have seen success with an increase in active betting accounts among young women, with a seven percent growth two years ago and this year a 16 percent growth,” Mr. Cheung said.

With regard to commingling, a topic first posited at the 31st Asian Racing Conference in Dubai in 2007, Mr. Cheung said the Club’s investment in bespoke content for overseas customers is yielding strong benefits since the endeavor began in 2014.

“By the end of the 2015/16 season, we were at about US$400 million in turnover. For this season we’re looking at about US$2 billion and that will continue to grow,” he said.

Emerging technology use, including leveraging artificial intelligence and the chatbot concept may not immediately result in turnover increases, but is required to meet emerging customer segment demands.

“We still need to do it. This is how future consumers, especially Generation Z, will function; we have to continue to adapt or it will be very difficult for us to stay relevant with the next generation of customers.”