The gambling industry in South Africa will become a Trillion Rand business in 2024.

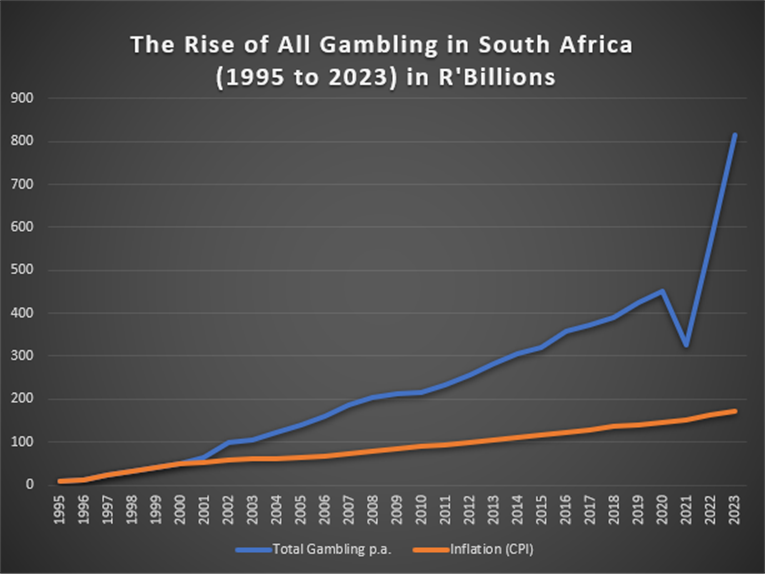

Over the past 28 years (1995 to 2023), total gambling turnover in South Africa has grown from R8 billion to R815 billion, a rise of 10 087 % (ten thousand percent) writes Robin Bruss.

The growth of betting has been a rocket ship since the Covid blip (2020/21), growing from R326 billion to R815 billion in the past two years.

The gambling industry in South Africa will become a Trillion Rand business in 2024.

In this article, the first of a three part series, I want to explain an overview. Afterwards we can drill down into more detail and try to analyse the age old questions of WHY and WHAT NEXT.

Opinions without contextual fact do not lead to wise decisions any more than backing horses without studying form.

So let’s take an overview of context as it weaves its way through some racing’s recent tumultuous history and try to understand how we have arrived at where we are now.

Then we can explore causes and try to come to a rationality so that the Sport of horseracing can be guided into stability and profitability.

The ultimate goal is that EVERYONE involved in this sport can share in a success story, derive a decent living, and not be unfairly disadvantaged.

The Gambling’s incredible growth in South Africa requires context so we start by relating it to another mature industry:

South Africa compared to Great Britain and Australia

Great Britain has a population of 68 million people. South Africa’s population is 60 million. According to the UK Gambling Commission, the total gambling market in Great Britain in 2023 was £15,1 billion (R384 billion).

South Africa’s total is R815 billion, which is more than DOUBLE that of Great Britain. And yet the GDP per capita (average income per person) of $45,000 in Great Britain is SIX times that of South Africa at $7,000.

Do we really have a propensity to gamble that is 12 times that of Great Britain?

Australia had a national gambling aggregate of A$25,49 billion (R312 billion) in 2021, the last recorded figure I could find, and their population is less than half of South Africa at 25 million people.

Dividing the aggregate by the number of people would make the average spend of an Australian to be R12,450 and the average by a South African to be R13,583.

In terms of the continent of Africa, South Africans bet more than HALF of the aggregate of all the other 53 countries.

It seems to be true that we are a nation of gamblers.

The Context of the National Lottery and its purpose

When the National Lottery was established in 1997, it was believed by Government that it would become the dominant form of gambling in South Africa. It was even given its own act, The National Lotteries Act (1997) separate from The National Gambling Act 2004. The performance however has been far below what was expected.

It is said that a State Lottery is for people that don’t understand arithmetic! If R5,6 billion is bet at Daily Lotto price of R3 per ticket, then what are your odds of winning? It’s 200m to one.

In a Casino bet, the Return to Punter in winnings is 94,8%. In Bingo, its 95%. In Slots, its 93%. In the Tote its 86,8%. (National Gambling Board statistics 2023)

It seems that South Africans do understand arithmetic!

The Tote in relation to other forms of gambling has the burden of having to provide for takeout for government tax, operator’s costs and prize money – hence the return to punter is lower by comparison to other forms of gambling, and this may also be a reason for its steady decline.

I can’t leave the matter of the National Lottery without making an observation.

In 2022, National Lottery ticket sales of R5,6 billion were equivalent to less than 0,6% of the total of all GAMBLING.

The National Lottery’s purpose, when created from a recommendation by the Wiehann Commission on Gambling Policy (1993), was to create a mechanism for gambling to contribute to CHARITY which includes formal registered charities, sporting bodies, arts and culture and other Non Profit Organisations.

In 2023, the amount paid to year to Sports bodies and other charities after deduction of prizes and costs, was R1,2 billion.

The figure of R1,2 billion sounds like a lot of money, but according to the Department of Social Welfare, in 2022 there were more than 186,000 registered charities in South Africa and a further 266,000 Non-Profit Organizations (NPOs).

The National Lottery Distribution Board Annual Report 2022 notes that R1,2 billion was granted to 3,692 beneficiaries, meaning an average payment of around R325,000.

In relation to the needs of the 186,000 registered Charities and 266,000 NPOs, it seems that grant funding to only 3,692 beneficiaries addresses only less than 1% of charitable need – and in relation to R815bn bet plus R5bn lottery, the grant of R1,2bn represents just 0,1%.

One can’t help but feel that the National lottery, as a vehicle for gambling to make a contribution to public benefit, is disappointingly small.

Phumelela’s purpose in its 1998 set up

Phumelela was set up as a public company – a modern, transparent, shareholder owned construct licensed in 7 of the 9 provinces, designed to use the leverage, gearing and resources of a publicly listed enterprise to grow the business, make a bucket load of money and enrich the shareholders, of which the Racing Association started out with 38% of the shares.

Its Vision was: “To be recognized as a global leader in the betting market.”

How ironical it is then that Phumelela Gaming and Leisure Limited, should go bankrupt in 2020, despite having inherited all of racing assets for virtually nothing in 1995, and had been given a first line advantage with the first licensed Sports betting (the Soccer Six) and the first global co-mingling of tote wagering on horseracing (a forerunner of today’s incredibly successful HKJC owned World Pools Bet).

They also had at their disposal the power of a JSE Listed company with favoured BEE credentials, and therefore had the muscle to invest in any or ALL of other gambling enterprises in their quest to fulfil their vision.

They could have applied their minds in what has become a 28 year bull market to grow their gambling business into a giant which could have included casinos, online betting, global pools, bookmaking and wagering, gaming and a local and global media business to support it. But they did not.

Phumelela took its share price from R4 to a peak of R23 before its collapse to zero. That’s 475% growth at its peak. How does that look now against the backdrop of its own industry that has grown more than 10 000% in a similar period.

Had Phumelela achieved the 10 000% growth by leading or even riding the wave of Gambling’s rise, as they were supposed to, its share price would be around R435 and with more than 99,6 million shares in issue, it would be a R40 billion company today and the Racing Association would be holding some R12 billion in assets – and the Sport of Racing would have been the King of Sports in South Africa and one of the richest racing jurisdictions in the world. An opportunity lost.

As we look at it now, it is the privately owned Hollywood Bets and World Sports Betting that have risen from humble beginnings in the betting arena to challenge and surpass the big guns of the entire gambling industry.

In horseracing terms, it’s like the 33/1 shots becoming the super champions of the era, whilst the 1/5 favourite falls down just as the finish line is in site.

And now, as a consequence in the sport of racing, we have multiple changes in the order of things, as racing administrators attempt to re-establish the sport and its mechanism of funding from gambling as a competitor in a field of other challengers for the gambling Rand. We in racing terms are back in the progress plates.

But here is the thing, whereas the gambling Rand was once thought to be limited, it’s turned out to be more robust and elastic than anyone could ever imagined.

If I had to state one reason why Phumelela did not succeed in its objectives, I would say it was the misunderstanding of the business of gambling by its board, and its failure to recognize the major TRENDS in gambling and gaming.

Instead of building a gambling colossus, the Board was busying itself with the politics of wrestling control of all of racing’s internal organisations in what was termed a ‘Vertical Integration Policy’, which was the hallmark of the Late M Jooste’s style of business: own a controlling share in everything.

“You don’t have to own the whole of each business” said Marcus Jooste to me in an interview for Tellytrack some years ago, “just enough to have the control – and when you have control of the entire value chain, as we have done in Steinhoff, then you can point the entire business in the direction that your board desires. This is what I mean by a policy of vertical integration”.

Phumelela and The Tote

The heart of Phumelela and of horseracing in the 1990s was the TOTE, as it owned 66% of ALL gambling back in 1995 at a figure around R8 billion.

When the new South Africa integrated the casinos back into South Africa from the ‘homelands’ in 1995, everything changed in the legislation and the Tote and Bookmakers would have to compete with casinos, slots and bingo.

The formation of Phumelela was supposed to be the solution proposed to take racing into a competitive environment.

By being granted the first license for Soccer Pools to be run on the Tote, they believed that they would open an untapped market in sports betting into the tens of millions of soccer supporters and it would become a bonanza and make Sports Betting an extravaganza.

And it’s true: Sports betting has become a Bonanza – Just not the Tote’s version of it.

Whether the problem lay in lack of proper rollout, lack of media or marketing, lack of strategic partnerships, or lack of planning, the Tote’s version has been puny.

Compare:

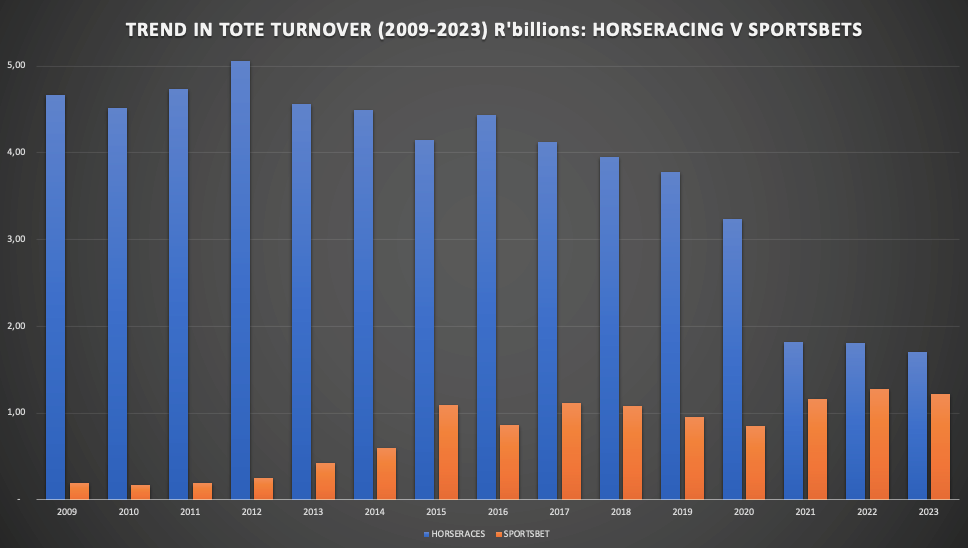

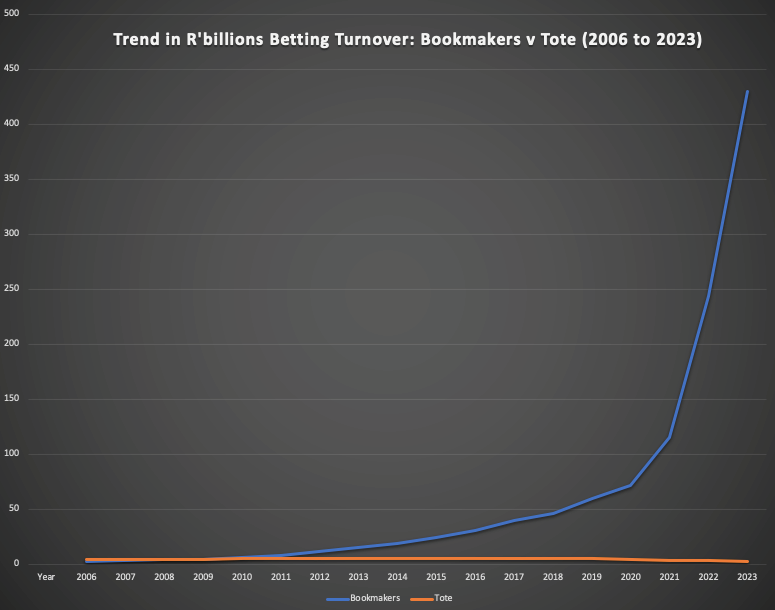

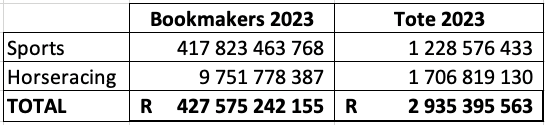

In 2009, BOOKMAKER’s turnover on Sports was just R854 million and on racing it was R2,87 billion.

By 2023, bookmaker turnover had rocketed to R417 billion on Sports and R9,75 billion on horseracing.

In 2009, the TOTE’s Soccer Pools were just R191 million turnover and by 2023, had grown to only R1,2 billion.

The Tote on its core product of horse racing has been abysmal with no growth at all. From R6 billion turnover at the outset of Phumelela in 1998, it declined to R4,67 billion by 2009 and to R1,7 billion by 2023– a DECLINE of 71%

The graph below shows the precipitous decline of the Tote. It was deeply affected by the collapse of Phumelela and Covid (2020-2021), moreso the core product of horse racing betting.

4 Racing and the Tote

In 2022, 4Racing Pty Ltd bought the racetracks and physical assets of Phumelela together with the Tote, but decided against acquiring the substantial bookmaking assets of Phumelela save for I think one license. The rest were sold to British corporate bookmakers Betfred.

4Racing indicated that their intention was to restore the Tote on horseracing to its former glory and this hope continues, although the 2022 and 2023 figures showed rather disappointingly that not much progress has been made.

The statistics to year end 31 March 2024 are not yet available and hopefully will provide some indication of turnaround.

We can examine some of the known reasons why the Tote performance is so abysmal in Part 2.

Part of it is structural, part of it is legislative, part revolves how it is taxed compared to other competing products and part is the effect of what is known as the Open Bet.

Having said all that, it is pretty obvious that the core business of the Tote in horse racing has been pretty much neglected over years, its loyal punters have been lost, its media distribution channeled through paid cable channel on DSTV (which according to Multichoice was one of the least viewed channels).

In 2019, the Multi Choice survey showed that viewership was 10,000 people, and therefore it does not reach the penetration one would hope for in a country of 60 million people. Horseracing is no longer on radio and very rarely are even the festival meetings shown on widespread terrestrial television coverage.

It has lost its position in the media eye whereas the wealthy bookmaking chains are everywhere.

Whatever the detail of the reasons, the decline of the Tote has badly affected the Sport which it is meant to serve.

The Tote’s failure to grow is summed up in a single statistic:

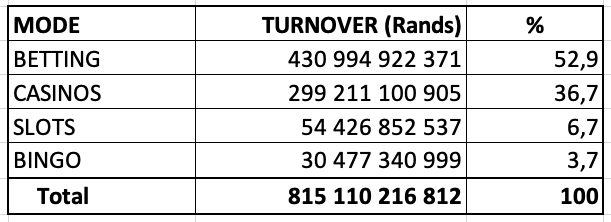

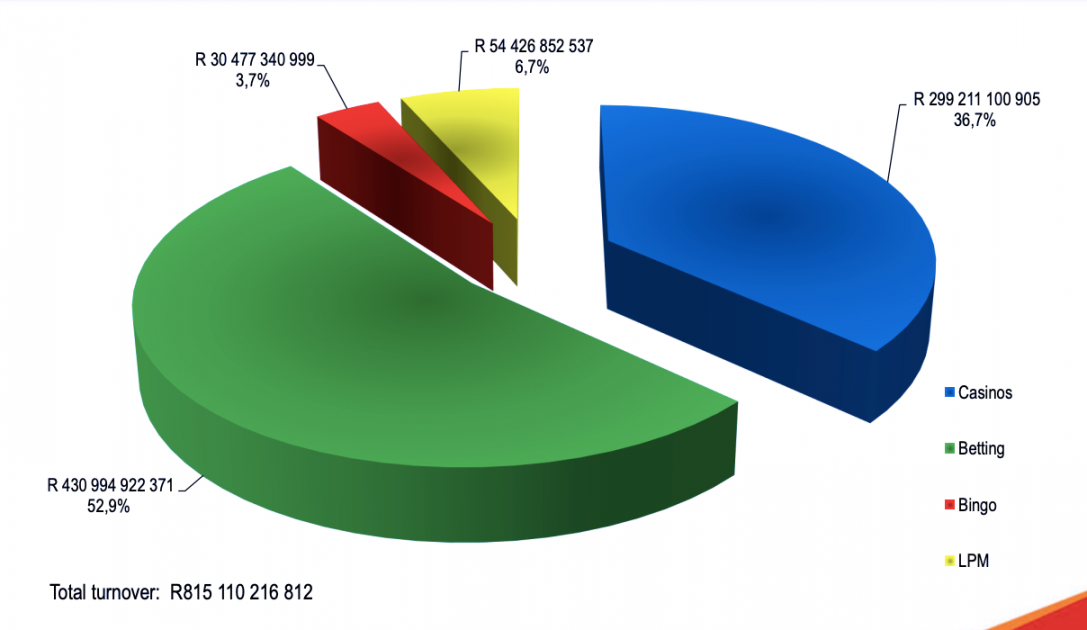

From 66% share of alI national gambling in 1998, the once mighty Tote sits at a lowly 0,3% of all gambling in 2023 whereas Bookmaking accounts for 53% of all gambling.

Now you begin to understand why bookmaking products are everywhere and why they are visible every day and in every walk of life.

You also begin to understand why Bookmaking chains are now also the single biggest contributors to Sports Sponsorships and in many cases, to charitable funding as well.

We will re-examine this in Part 3.

Let’s now examine horseracing’s position against ALL types gambling in 2023.

All Gambling Turnover per mode 2022/23 (to 31 March 2023).

(Source: National Gambling Board published statistics)

Graph Of All Gambling Turnover Per Mode (2022-2023)

(Source: National Gambling Board)

Horseracing’s share of the whole Betting Market:

As the graph below shows, it was ten years into Phumelela’s existence that – in 2010 – the Bookmaker’s betting turnover went past the Tote for the first time at R4,6 bn.

Then it became an unstoppable rocket ship and increased a hundredfold over the next dozen years.

Where does horseracing betting sit inside the Bookmaker’s upwardly mobile growth curve? It’s about 2,15%.

In 2023, Bookmaker’s turnover on horseracing was R9,75 billion.

We, in racing, might think it looms large in the minds of the bookmakers, but in fact, it’s a very small part of their business, dwarfed by the R417bn turnover in “Sports” betting.

I used the term “Sports” betting because today it also includes sports such as lucky numbers, roulette, blackjack and poker. In fact, casino style betting, masquerading as Sports, probably accounts for a lot of the growth curve that we have seen.

Hollywoodbets, World Sports Betting, Mary Slack and Greg Bortz

Hollywoodbets involvement in racing is really interesting.

It has acquired both Western Cape Racing’s assets and Gold Circle’s in deals with Greg Bortz, who has rearranged Cape Racing in a revolutionary and spectacular way with decisive leadership and a can do attitude which is admirable.

That Greg Bortz and Hollywoodbets are about to do the same in KZN is both exciting and enthralling – an entrepreneurial and innovative spirit we are not used to seeing in horseracing.

It is apparent that Owen Heffer’s Hollywoodbets are gigantic supporters of horseracing in spite of the betting statistics which indicate that horseracing betting must be a minor player in their gambling businesses, both in South Africa and internationally.

Their contribution comes from a love of the game and thankfully, as they are privately owned, they don’t have to account to outside shareholders for their magnanimity and support.

Bortz and Hollywoodbets will breathe new life into horseracing’s betting markets as much as they have done in relation to support for the Sport, in sponsorships and marketing, the Hollywood racing syndicate and the multiple donations and support for racing’s non-profit bodies.

Similarly, World Sports Betting (Pty) Ltd has become a large sponsor of Horseracing’s big events, especially in Gauteng where their betting presence on the course is also bigger than that of the Tote.

Established by Warren Tannous in 2002, World Sports Betting is licensed by Gauteng and National Gambling board and like Hollywoodbets, it has established itself in multiple betting mechanisms, and not only operates countrywide, but is also a global operation.

The intervention of Mary Slack’s MOD Trust to set up 4Racing Pty Ltd, saved Gauteng racing from collapse, and it’s ongoing contribution month after month, enables Gauteng and the Eastern Cape racing a stability that they would not have had. In addition, their contribution to employees and BEE has been outstanding.

I don’t think words are adequate to express the admiration that racing’s participants feel about this, and their gratitude comes with respect and acknowledgement that is well deserved.

As we review the gambling trends, we can’t help but realise that the enormity of such an intervention and the support of the bookmaking chains has saved the Sport of horseracing from collapse, as it has emerged from the double whammy of Phumelela’s demise and the effects of Covid’s stoppage.

That said, as the Tote is the life blood of racing’s gambling income – it is the legislated source of funding of the operations and prize money – it’s future has to be addressed in earnest if racing is to survive into the future and grow and prosper

If it is not addressed, racing might well be reduced to a begging bowl from bookmakers, sponsors and philanthropists in order to continue.

And whilst such support from all three parties right now is gratefully received, it is not a solution for sustainability of an entire industry.

In Part 2, we will drill down further in what is an important and fascinating subject.